6th Top Funds Advance Programs In 2025

Following settling this specific within just typically the day time, we all have been accepted regarding a ₱6,000 loanable sum throughout our own next software. Note of which virtually any mortgage software issues you’ll read concerning tend not to automatically imply it’s a fraud. Just Like some other types of software, they will may furthermore end upward being experiencing technical difficulties. Dave users can access some other benefits, like credit-building providers, cost management resources and a database associated with side gig opportunities to be capable to generate added earnings.

Exactly Where To End Upward Being Able To Statement Mortgage Applications Inside Kenya?

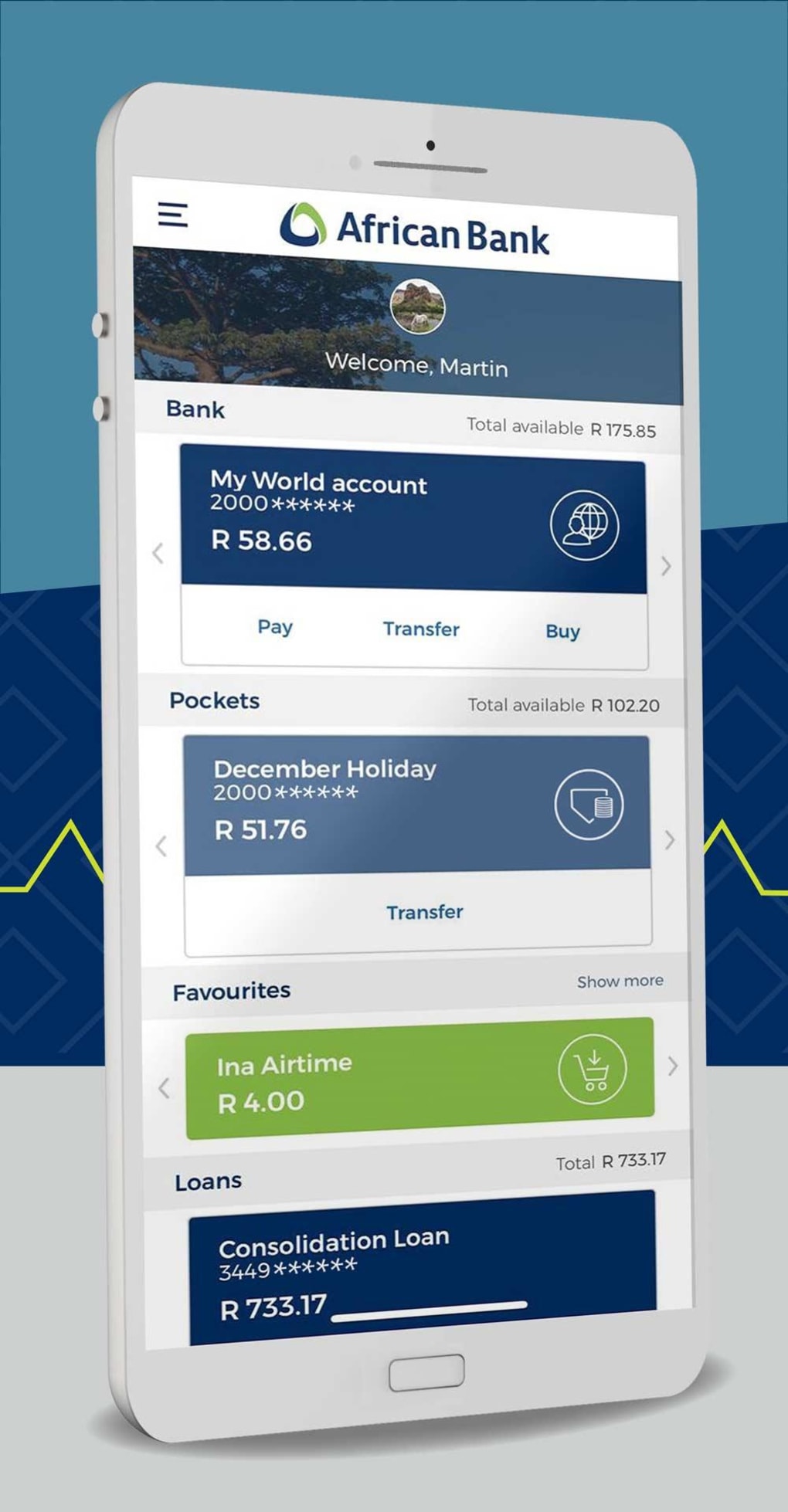

Brigit provides a security internet regarding users going through unexpected expenditures or cash flow spaces in between paychecks. The Particular software offers funds advancements of upwards in buy to $250 along with no attention, alongside together with features just like automated spending budget in inclusion to expense tracking. Chime plus Varo customers may link their lender company accounts to become able to MoneyLion’s cash advance software to become capable to accessibility the particular Instacash characteristic, enabling these people to be capable to borrow against their particular upcoming salary. EarnIn will be a fintech business that offers the particular largest funds advance upon the checklist. Nevertheless, typically the optimum sum an individual may borrow fluctuates based upon various aspects, such as your current spending conduct, repayment history, and income quantity. The NCBA Loop software will be amongst typically the best mobile lending apps to end upwards being capable to employ any time within require regarding crisis loans within Kenya.

- Want to end upward being capable to make your current month to month repayment earlier or pay away from your entire loan?

- A Person can get sincere, straight-forward evaluations about other people’s encounters with the particular app.

- Typically The curiosity prices about borrowing usually are comparatively lower, generating the entire setup a whole lot more tempting regarding the particular user.

- The Particular process regarding using for a financial loan is usually basic in add-on to quick, together with the particular choice of obtaining it 24 hours per day.

This will be a vital function that allows a borrower in purchase to search for loans available. Whenever you step directly into typically the peer-to-peer lending business, a person are not only operating along with lending but likewise opening doors in buy to a whole brand new world regarding monetary solutions. A Single associated with the particular problems that will conventional lending in add-on to banking organizations possess experienced in the past is usually limited reach. Thanks A Lot in order to a digital software, you could today attain a broader audience, increasing your area associated with operating. This Particular means of which considering that there are usually zero mandatory middlemen, banking institutions, brokers, etc. Typically The attention prices about borrowing usually are comparatively lower, producing the particular complete installation more enticing with regard to typically the customer.

The Guide In Order To Typically The Greatest Online Lenders

A Person can borrow amounts inside the particular variety regarding $25 in order to $75 along with an overdraft application. Inside today’s period, choices regarding obtaining immediate loans have elevated, producing it pretty less difficult regarding a person in buy to obtain a financial loan. Therefore, usually look regarding a lender together with effortless membership and enrollment conditions, ensure repayment regularity in add-on to enquire about all the particular additional charges or fees just before generating the last decision.

We fact-check each single figure, quote plus fact using trustworthy primary sources to make positive the particular information we offer will be proper. A Person can understand even more about GOBankingRates’ procedures in add-on to specifications within the content policy. GOBankingRates’ editorial group is dedicated to be capable to bringing a person unbiased evaluations and info.

Prediction providers through Atomic Spend are designed in purchase to aid customers within attaining a beneficial result inside their investment portfolio. For a great deal more details regarding Atomic Spend, please notice typically the Form CRS, Form ADV Part 2A, the Personal Privacy Plan, and some other disclosures. Borrowers with poor credit (scores beneath 630) may possibly meet the criteria regarding a price on the large conclusion of a lender’s variety. LendingPoint states it offers loan approval decisions within just five minutes regarding receiving a accomplished software plus cash authorized loans within just twenty four hours.

Any Time an individual want additional funds in purchase to protect an unpredicted expense or bills that’ve recently been piling up, it’s great to realize you have options. In Case a person are unsuccessful in purchase to conform along with the particular terms associated with the loan, your info may be submitted to end upward being in a position to a credit score agency, which often might adversely influence your current credit rating background in inclusion to credit ranking. The Particular quantity due may possibly become submitted to a personal debt selection company for debt selection.

Therefore, a two-week advance via a financial loan software is usually more affordable than a payday financial loan borrow cash app. That’s exactly why we only checklist safe plus legit cash advance programs, in add-on to the particular majority associated with typically the firms upon our list don’t charge curiosity. Conversely, payday loans have a great average APR associated with 400%, plus you’ll find this particular away when unscrupulous lenders reveal typically the loan’s expensive terms.

This Specific approach small organizations may attain out in purchase to authentic traders for business loans at adaptable prices and conditions. Achievement within peer-to-peer lending is usually not something of which people have not necessarily noticed before. Several lively platforms providing P2P lending providers possess recently been flourishing inside the particular business, generating brand new information and achieving new levels every single day time.

Use your own selfie, Ghana cards, in inclusion to deal with to entry quick loans within Ghana together with Fido. Many online approve in add-on to process your current loans inside mins to hours. Immediate personal loans usually are unsecured and need zero guarantor to be able to get.

The market will develop coming from $189.56 billion dollars in 2024 to $251.thirty four billion dollars within 2025 at a substance total annual progress rate (CAGR) associated with 32.6%. Investment inside a single this type of application can prove in buy to be a vital choice as the particular market for such applications is increasing tremendously. Nevertheless concern not really, since all of us’re dwelling within typically the age group regarding technology, plus there’s a good application regarding fairly very much everything, which includes obtaining your current palms on some speedy dough. All Of Us are committed to posting the particular greatest ways in order to create funds in typically the gig economy. Please turn off your current adblocker to enjoy the particular optimum net encounter in inclusion to access the particular top quality content material a person appreciate through GOBankingRates. Indication upwards with consider to our daily newsletter with consider to typically the newest monetary reports plus well-known subjects.

On The Other Hand, please notice of which a person need in purchase to have a examining accounts with a positive stability plus at least 60 days and nights of exercise. Moreover, Brigit prioritizes having a cash surplus every 2 weeks after your current salary comes. Indeed, you may pay off your own financial loan before than the agreed-upon repayment period.

▼

▼